- Pay attention to the interest rates associated with your credit card and ensure you understand the rate you agreed to.

- Maintain a good credit score by paying bills on time and staying within your credit limit to access better rewards.

- Review your credit card’s rewards and benefits, such as cashback, discounts, points, miles, or other rewards.

- Set yourself up for success by creating a budget and setting realistic spending limits you can stick to each month.

A credit card can be a valuable financial tool that allows you to purchase items or pay for services with a line of credit. Many credit cards offer rewards and benefits that can help you maximize your spending. However, if you’re not careful, it can also lead to debt and bad credit. To get the most out of your new credit card, here are some tips to consider before taking out a new card.

1. Pay Attention to Interest Rates

Interest rates are the amount you will owe on top of what you purchased with your credit card. Generally, lower interest rates mean less money owed in the end. Read through all terms and conditions before signing up for a new credit card, so you know exactly what kind of interest rate you agree to pay. Some cards may offer an attractive introductory rate, but the interest rate rises after a specific time.

Some interest rates are variable, meaning they can change based on the current market. Be aware of how often the interest rate changes and what interest rate your card carries. You don’t want to be caught off guard by an unexpected increase in your interest rate.

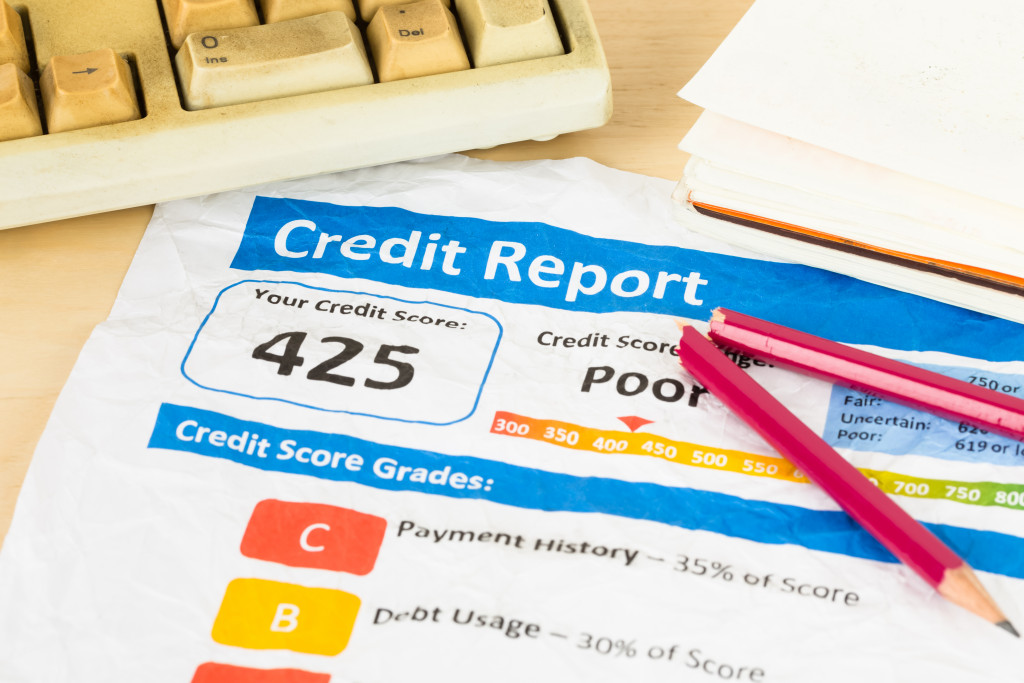

2. Maintain Your Credit Score

Most credit card companies will pull your credit score to decide if you’re a good candidate for the card. If you have bad credit, the company may not approve your application or may offer you a card with higher interest rates and fewer rewards. Keeping your credit score in good shape is essential to get the most out of your credit card. Make sure to pay your bills on time and stay within your credit limit, as these can significantly impact your credit score.

You can also improve your credit score by using a secured credit card, which requires you to put down a security deposit. A secured card will help you rebuild your credit score and give you a chance to prove you’re responsible with credit. If you use a secured card responsibly, you may be able to upgrade to an unsecured credit card with better benefits and rewards.

3. Review Rewards and Benefits

Many credit cards offer rewards programs that allow you to earn points and discounts when you use them. Review the rewards and benefits your card offers to make the most of them. Some cards offer the following:

a. Cash back on purchases

If your card offers cash back, make sure you use it for any items or services that you purchase with your credit card. This will help you get some of your money back and save on your overall purchases.

b. Points, Miles, or Other Rewards

If your card has a rewards system in place for points, miles, or other rewards, make sure to look into how to best use your points. Some cards may have bonus categories or special offers that can help you maximize your rewards.

c. Discounts on Travel and Purchases

Some cards may offer discounts on certain items or travel fares when you use your card. Make sure to take advantage of these benefits when you can, as they can help you save money on your purchases.

d. Special Offers

Many cards offer special offers for certain retailers or restaurants. Make sure to check the offers your card provides, as it can help you save money on purchases you normally make.

4. Set Yourself Up For Success

When applying for a new credit card it is essential to set yourself up for success by setting realistic spending limits and creating an organized budget plan that works within those limits. Once you have determined how much you can afford to spend each month, make sure that your monthly payments are equal to or greater than this amount. This will help ensure that your balance is paid off in full each month so as not to accrue interest charges and damage your credit score.

A new credit card can be an invaluable tool for managing your finances. However, it is important to use credit responsibly and follow the tips outlined above to ensure that you get the maximum benefit out of the card. Doing so will help you avoid debt and keep your credit score in good shape, allowing you to reap the rewards of having a credit card. With the right plan in place and a bit of financial discipline, you can get the most out of your new credit card.